The 1944 half dollar coin is worth between $25-$35 for circulated examples, while uncirculated coins can fetch $50 or more. High-grade specimens in MS-65 condition exceed $100, with exceptional examples reaching thousands of dollars. The coin’s 90% silver content provides a minimum melt value of approximately $19. Value is determined by condition, mint marks (Philadelphia/no mark, Denver “D”, or San Francisco “S”), and rare varieties. The 1944-S repunched mintmark error is particularly valuable, ranging from $30 to $42,000 for premium grades. All 1944 Walking Liberty half dollars contain silver, making them inherently valuable to collectors and investors alike.

That worn silver half dollar tucked away in your grandfather’s collection might be worth considerably more than fifty cents. The 1944 Walking Liberty Half Dollar represents one of the final years of this beloved American design, and while millions were minted across three facilities, specific examples now command prices that would shock their original holders. Understanding what separates a twenty-dollar coin from a thousand-dollar treasure requires examining mint marks, grading standards, and rare manufacturing errors that collectors actively hunt.

The Walking Liberty Design and 1944 Production Numbers

Adolph Weinman’s Walking Liberty design graced American half dollars from 1916 through 1947, depicting Lady Liberty striding toward the sunrise on the obverse with a majestic eagle on the reverse. The 1944 production year saw substantial mintages across three United States Mint facilities during World War II when silver coins still circulated widely.

Philadelphia struck 28,206,000 pieces without a mint mark, making these the most common variety. Denver’s facility produced 9,769,000 coins marked with a “D” on the reverse near the rim below the eagle’s left talon. San Francisco contributed 8,904,000 pieces bearing an “S” mint mark in the same location. Despite these high production numbers, uncirculated specimens remain scarce because most coins entered immediate circulation to support wartime commerce.

Each coin contains 0.36169 troy ounces of pure silver in its 90% silver composition, establishing a baseline melt value around nineteen dollars based on current precious metal markets. This silver content ensures no 1944 half dollar trades below its intrinsic metal worth, regardless of condition.

Understanding Coin Grading and Its Impact on Value

Professional grading follows the Sheldon Scale, ranging from Poor-1 through Mint State-70. For 1944 half dollars, condition dramatically influences market prices more than any other factor.

Good (G-4) grade coins show heavy wear with Liberty’s details mostly flat and the date barely legible. These typically sell for twenty-two to twenty-five dollars, barely above melt value. Fine (F-12) specimens retain basic design elements with moderate wear, commanding twenty-eight to thirty-two dollars.

About Uncirculated (AU-50 through AU-58) coins exhibit slight friction on high points but preserve most mint luster. These intermediate grades bridge circulated and uncirculated categories, valued between thirty-five and fifty dollars depending on specific grade.

Mint State (MS-60 through MS-70) designates uncirculated coins showing no wear from circulation. MS-60 pieces with numerous contact marks trade for fifty to sixty dollars. MS-63 examples with moderate preservation quality fetch seventy-five to ninety dollars. Premium MS-65 specimens displaying exceptional luster and minimal marks command one hundred fifty to three hundred dollars across all mint marks.

The rarest grades carry exponential premiums. MS-66 coins reach five hundred to eight hundred fifty dollars, while MS-67 specimens—with perhaps fewer than two dozen professionally certified for all three 1944 mint marks combined—exceed two thousand dollars when available.

Philadelphia No Mint Mark Values

Philadelphia-minted 1944 half dollars lack any mint mark designation, following historical practice for the main mint facility. Their higher mintage makes them slightly more affordable than Denver or San Francisco issues in comparable grades.

| Grade | Typical Value Range |

|---|---|

| G-4 | $22-$24 |

| F-12 | $27-$30 |

| XF-40 | $32-$36 |

| AU-50 | $38-$45 |

| MS-60 | $50-$60 |

| MS-63 | $72-$85 |

| MS-65 | $140-$280 |

| MS-66 | $475-$750 |

| MS-67 | $1,800-$2,600 |

Heritage Auctions recorded a remarkable MS-67+ example selling for three thousand one hundred twenty-five dollars in January 2023, demonstrating how exceptional preservation commands premium pricing even for common date coins.

Denver “D” Mint Mark Pricing

Denver’s lower mintage creates marginally stronger demand among collectors completing date-and-mintmark sets. The “D” appears on the reverse beneath the eagle’s left talon—collectors should use magnification since decades of circulation often wear this small letter.

Circulated Denver half dollars track Philadelphia prices closely, with G-4 specimens at twenty-three to twenty-six dollars and XF-40 examples reaching thirty-four to thirty-eight dollars. The differentiation emerges in uncirculated grades where Denver coins command slight premiums.

MS-60 pieces sell for fifty-five to sixty-five dollars, while MS-63 specimens reach eighty to ninety-five dollars. Superior MS-65 examples trade between one hundred sixty and three hundred twenty dollars. An MS-66 Denver coin sold through Stack’s Bowers in October 2023 for seven hundred ninety dollars, reflecting strong collector interest.

MS-67 and higher grades remain extremely scarce. Professional Coin Grading Service (PCGS) population reports show fewer than fifteen MS-67 examples certified as of late 2024, with these rarities commanding two thousand two hundred to three thousand dollars when offered.

San Francisco “S” Mint Mark Specimens

San Francisco produced the lowest mintage among 1944 half dollars, though not dramatically fewer than Denver. The “S” mint mark appears in the identical location as Denver’s “D”—below the eagle’s left talon on the reverse.

Standard circulated grades mirror other mint marks with G-4 coins at twenty-three to twenty-seven dollars and AU-50 pieces reaching forty to forty-eight dollars. Uncirculated examples show more pronounced value differences.

MS-60 San Francisco coins start at fifty-eight to sixty-eight dollars. MS-63 specimens command eighty-five to one hundred five dollars, while MS-65 pieces range from one hundred seventy-five to three hundred fifty dollars based on eye appeal factors like toning and strike sharpness.

The San Francisco issue includes a significant variety—the repunched mint mark discussed separately below—that creates additional collector interest beyond standard strikes. High-grade MS-66 examples without varieties sell for six hundred to nine hundred dollars, with MS-67 specimens exceeding two thousand five hundred dollars.

Valuable Error Varieties and Manufacturing Mistakes

Manufacturing irregularities transform ordinary coins into sought-after rarities. The 1944-S/S Repunched Mintmark (RPM) represents the most significant variety for this date, occurring when the mint mark punch struck twice in slightly different positions.

Examination under ten-power magnification reveals doubled edges or notches around the “S” mint mark. Minor repunching with slight doubling adds fifteen to twenty-five percent premiums in lower grades. Dramatic repunching showing clear separation between impressions multiplies values substantially.

According to Greysheet pricing from December 2024, a strong 1944-S/S RPM in MS-63 condition reaches two hundred fifty dollars compared to ninety dollars for a regular strike. MS-65 RPM specimens command six hundred to nine hundred fifty dollars, while an exceptional MS-66 example sold for four thousand two hundred dollars through Heritage Auctions in March 2023. The finest known MS-67 repunched mint mark specimen achieved an astounding forty-two thousand dollars in a 2019 auction, establishing the record for any 1944 half dollar variety.

Additional errors worth examining include:

Die Cracks and Cuds: Raised lines or blob-like projections from damaged dies add twenty to one hundred dollars depending on size and location. Major cuds affecting Liberty’s figure or the eagle command stronger premiums.

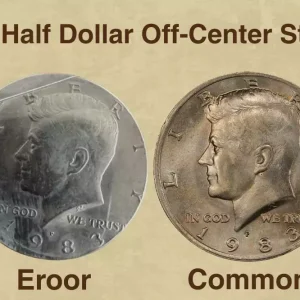

Off-Center Strikes: Coins struck with misaligned dies showing partial missing design elements. Minor shifts of five to ten percent add fifty to one hundred fifty dollars. Dramatic off-center strikes exceeding twenty-five percent with full date visible reach three hundred to eight hundred dollars.

Double Die Varieties: Subtle doubling in letters or design elements, particularly in “LIBERTY” or the date. Most 1944 examples show minor doubling worth modest thirty to seventy-five dollar premiums, though pronounced doubling commands significantly more.

Lamination Errors: Metal separation creating flaking surfaces from impurities in the silver planchet. Visible laminations add forty to one hundred twenty dollars depending on size and location.

Authentication and Professional Grading Considerations

Submitting coins for professional certification through PCGS or Numismatic Guaranty Corporation (NGC) provides authentication, precise grading, and protective encapsulation. Services charge fifteen to thirty-five dollars per coin for standard submissions, with expedited options costing more.

Professional grading makes economic sense for coins likely grading MS-63 or higher, where precise grade distinctions create hundred-dollar price differences. A coin self-assessed as MS-64 but officially graded MS-65 might jump from one hundred fifty to two hundred eighty dollars in value—easily justifying the grading fee.

For circulated examples below About Uncirculated grades, professional certification typically isn’t cost-effective unless rare varieties are suspected. Repunched mint marks, significant die errors, or unusual characteristics warrant expert authentication regardless of base grade.

When examining raw (uncertified) coins, scrutinize for cleaning, polishing, or artificial toning that diminishes value. Original skin and natural patina command premiums, while harsh cleaning can reduce a coin’s worth by thirty to fifty percent even if technically high grade. Unnatural rainbow toning or surfaces showing hairline scratches from abrasive cleaning indicate problems.

Strategic Collecting and Investment Perspectives

Building a complete 1944 half dollar set—Philadelphia, Denver, and San Francisco in matched grades—provides an achievable collecting goal. Mid-grade AU-50 to MS-60 specimens totaling one hundred fifty to two hundred dollars create an attractive entry point showcasing all three mint marks.

Advanced collectors pursue condition census coins—the finest known examples of each variety. Competition for MS-66 and MS-67 specimens drives prices into four figures, but these coins represent the preservation elite with established track records appreciating over time.

The repunched mint mark variety offers a specialized collecting niche within the broader 1944 series. Starting with lower-grade RPM examples around thirty-five to seventy-five dollars allows collectors to own this variety before potentially upgrading to premium specimens.

Silver content provides downside protection regardless of numismatic premiums. With nineteen-dollar melt value floors, 1944 half dollars benefit from both precious metal appreciation and collector demand. This dual-component value proposition differentiates silver coins from base metal issues relying solely on numismatic interest.

Market liquidity remains strong for Walking Liberty Half Dollars generally. Major dealers, auction houses, and online marketplaces actively buy and sell these coins, ensuring owners can convert holdings to cash relatively quickly compared to more obscure series.

Where Serious Collectors Find Exceptional Specimens

Heritage Auctions conducts weekly online sales featuring hundreds of Walking Liberty Half Dollars, including 1944 issues across all grades. Their detailed photography, population data, and price-realized archives provide valuable market research tools even for those not currently bidding.

Stack’s Bowers Galleries specializes in high-grade rarities, often featuring MS-66 and MS-67 specimens in their quarterly auction catalogs. Their expert cataloging identifies subtle varieties and provides authentication for premium pieces.

Great Collections operates a weekly Sunday night auction format with no buyer’s premium for bidders, making their realized prices particularly useful for establishing fair market values. They offer raw and certified coins across all price points.

Local coin shows provide hands-on examination opportunities before purchasing. Major metropolitan shows attract dealers specializing in Walking Liberty Half Dollars who bring inventory specifically for collector viewing.

Online marketplaces like eBay offer abundant selection but require careful authentication. Purchasing only PCGS or NGC certified coins through these channels minimizes counterfeit risks, though buyers should verify holder authenticity and compare prices against recent auction results.

Maximizing Value When Selling Your Collection

Proper photography highlighting details collectors evaluate proves essential for online sales. Sharp images showing both full coin faces and close-ups of mint marks, dates, and surface quality under angled lighting demonstrate transparency that builds buyer confidence.

Timing sales around numismatic events creates visibility. Major auction houses scheduling Walking Liberty collections or broader silver coin sales attract the most serious bidders with deepest pockets for premium specimens.

Multiple quotes from established dealers establish baseline values, though auction consignment often realizes higher prices for rare varieties and exceptional grades. Dealers typically offer sixty-five to seventy-five percent of retail value, while auctions target full market price minus seller commissions of ten to twenty percent.

For modest circulated examples, local coin shops provide immediate payment convenience despite slightly lower offers. Selling common-date circulated pieces individually online rarely justifies the time investment versus bulk sale to dealers.

Rare varieties and high-grade specimens deserve specialized treatment. Consigning repunched mint marks or MS-66+ coins to Heritage, Stack’s Bowers, or similar firms positions these pieces before thousands of active bidders, maximizing competitive bidding that drives final prices.

Building Knowledge for Confident Collecting

That drawer of inherited coins might contain hidden value waiting for informed examination. Checking mint marks, assessing condition honestly against grading standards, and identifying potential varieties transforms casual ownership into strategic collecting. Whether seeking one representative example or pursuing completion of a full set across mint marks and grades, 1944 Walking Liberty Half Dollars offer accessible entry into silver coin collecting with genuine appreciation potential for premium specimens.

You may be interested:

- 1859 Indian Head Penny Coin Value Complete Errors List And No Mint Mark Worth Guide For Collectors

- 1911 V Nickel Coin Value Guide Complete Errors List And No Mint Mark Worth Today

- 1902 Dime Coin Value Complete Errors List With O S And No Mint Mark Worth Guide

- 1788 Quarter Coin Value Complete Guide Errors List And D S P Mint Mark Worth Revealed

- 1776 To 1976 Bicentennial Half Dollar Coin Value Complete Errors List And What Your D S And No Mint Mark Coins Are Actually Worth

- 1990 Penny Coin Value Errors List How D S And No Mint Mark Pennies Are Worth Thousands Of Dollars

Are there any rare 1944 half dollar errors?

Rare and intriguing, this 1944 D Silver Half Dollar from the United States features an **AW** engraving error, adding a unique touch to the Liberty Walking design. Struck in 0.9 fineness silver at the Denver Mint, this circulated coin is a must-have for any collector of rare and unusual numismatic pieces.

How much is a 1944 half dollar coin worth today?

A 1944 half dollar coin is worth between approximately $25 and $35 for common circulated coins, while its value can rise to over $1,000 or much more for high-grade examples, with certain rare varieties and errors commanding even higher prices. Its value is determined primarily by its condition, or “grade,” and any specific mint marks or unique errors it may have. The coin also has a base melt value due to its 90% silver content, which provides a minimum value of around $19.

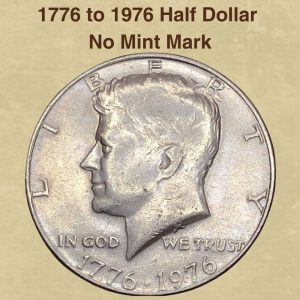

Is a bicentennial half dollar with no mint mark worth anything?

A 1776 to 1976 Bicentennial half dollar with no mint mark is a common clad coin from the Philadelphia mint, worth its face value of $0.50 in circulated condition, and slightly more in uncirculated condition. The value depends on its condition, with a circulated coin worth around 50 cents and an uncirculated one potentially fetching $5 to $10 or more, though specific high-value errors or rare variations are what drive prices higher.

How can I identify a rare Kennedy half dollar?

To identify a rare Kennedy half dollar, look for coins from specific years like 1964, 1965-1970, or 1971-present, and check for errors or varieties such as a missing “FG” initial, a double die, or a 1974D double die obverse. Also, consider coins in high-grade, uncirculated condition, which increases value.