A standard 1951 dime ranges from $2-$5 in circulated condition, with the 1951-S variant worth $3.50-$4.60. Uncirculated 1951-S dimes can reach $300. Error coins command premium prices: the 1951-D Double Die Obverse sells for $20-$100 depending on grade, while the 1951-D Over Mint Mark error ranges from $30-$120. All 1951 dimes contain 90% silver, providing base melt value. Coin condition and market demand significantly impact final prices, with higher-grade examples commanding substantially more than circulated specimens.

Most collectors walk past 1951 Roosevelt dimes without a second glance, assuming they’re worth face value. That’s a costly mistake. While millions were minted that year, specific varieties and error coins can command premiums reaching $300, with certain double die and over mint mark specimens selling for $120 or more in pristine condition. Understanding what separates a $2 common coin from a $300 treasure requires examining mint marks, grading standards, and error characteristics that most people overlook.

The Silver Foundation Every 1951 Dime Shares

Every 1951 Roosevelt dime contains 90% silver and 10% copper, weighing 2.5 grams with a diameter of 17.9 millimeters. This silver content establishes a baseline melt value that fluctuates with precious metal markets. At current silver prices, the intrinsic metal value hovers around $1.80 to $2.10, regardless of mint mark or condition.

This silver composition means even heavily worn examples retain worth beyond face value. However, collector premiums quickly surpass melt value for coins in better condition or those displaying desirable characteristics. The United States Mint produced these dimes at three facilities in 1951, each leaving distinctive marks that significantly impact value.

Philadelphia Mint: The No Mint Mark Standard

The Philadelphia Mint struck 103,937,602 Roosevelt dimes in 1951 without applying any mint mark. These coins display only Roosevelt’s profile on the obverse and a torch flanked by olive and oak branches on the reverse, with no letter designation near the torch base.

Value by Grade:

| Grade | Typical Value |

|---|---|

| Good (G-4) | $2.00 |

| Fine (F-12) | $2.00 |

| Extremely Fine (EF-40) | $2.00 |

| About Uncirculated (AU-50) | $2.25 |

| Mint State (MS-60) | $4.00 |

| Mint State (MS-65) | $18.00 |

| Mint State (MS-67) | $45.00 |

The massive mintage means Philadelphia examples remain plentiful in all grades. Circulated specimens typically trade for $2 to $2.50, barely above melt value. Uncirculated coins become interesting around MS-65, where sharp strikes and attractive luster push values to $18. Gem examples grading MS-67 or higher can reach $45 to $60, though these represent less than 1% of surviving specimens.

Denver Production: The D Mint Mark Coins

Denver’s mint produced 56,529,000 dimes in 1951, identifiable by a small “D” mint mark positioned on the reverse, just above the torch base. While mintage numbers were lower than Philadelphia, Denver coins remain readily available in circulated grades.

Standard 1951-D Values:

| Grade | Typical Value |

|---|---|

| Good to Fine | $2.00 |

| Extremely Fine (EF-40) | $2.00 |

| About Uncirculated (AU-50) | $2.50 |

| Mint State (MS-60) | $4.50 |

| Mint State (MS-65) | $20.00 |

| Mint State (MS-67) | $65.00 |

Common circulated 1951-D dimes trade for $2 in most conditions. The Denver mint typically delivered slightly softer strikes than Philadelphia, making sharply struck uncirculated examples more valuable. MS-65 specimens command $20, while MS-67 grades jump to $65 due to relative scarcity at this preservation level.

San Francisco Rarity: The Premium S Mint Mark

San Francisco operated at reduced capacity in 1951, producing just 31,630,000 Roosevelt dimes, the lowest mintage of the three facilities that year. Each bears an “S” mint mark in the same reverse location as Denver’s “D.”

1951-S Standard Values:

| Grade | Typical Value |

|---|---|

| Good to Fine | $3.00 |

| Extremely Fine (EF-40) | $3.50 |

| About Uncirculated (AU-50) | $4.10 |

| Mint State (MS-60) | $8.00 |

| Mint State (MS-65) | $35.00 |

| Mint State (MS-66) | $110.00 |

| Mint State (MS-67) | $300.00 |

The lower mintage creates immediate premiums. Even worn examples trade for $3 to $3.50, approximately 50% above Philadelphia and Denver counterparts. Uncirculated 1951-S dimes become genuinely valuable, with MS-65 specimens reaching $35 and MS-66 examples commanding $110. The real prize lies in MS-67 condition, where prices approach $300 according to NGC price guides and recent Heritage Auctions results.

A 1951-S graded MS-67 Full Bands sold for $312 at a 2023 Heritage Auction, while another MS-67 example without full band designation brought $264. The “Full Bands” designation refers to complete horizontal separation lines visible on the torch’s central bands, indicating exceptional strike quality that fewer than 5% of uncirculated examples achieve.

The Double Die Obverse Error: Denver’s Premium Mistake

The 1951-D Double Die Obverse represents the most sought-after error variety from this year. This mistake occurred when the die used to strike coins received two slightly offset impressions during the hubbing process, creating visible doubling on design elements.

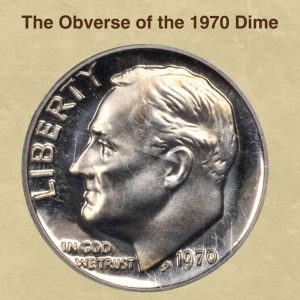

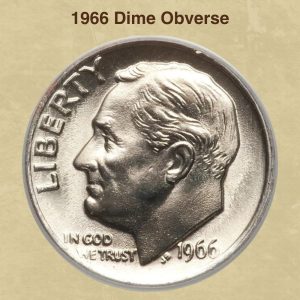

On 1951-D Double Die Obverse specimens, doubling appears most prominently on Roosevelt’s profile, particularly visible on the letters of “LIBERTY” and “IN GOD WE TRUST.” The date “1951” may also show slight doubling, though this varies by specimen severity. Under magnification, affected letters appear to have a shadow or echo effect.

1951-D Double Die Obverse Values:

| Grade | Value Range |

|---|---|

| About Uncirculated (AU-53) | $20 |

| Mint State (MS-60) | $35 |

| Mint State (MS-63) | $50 |

| Mint State (MS-65) | $100 |

| Mint State (MS-67) | $175+ |

A well-preserved MS-65 Double Die Obverse sold for $106 through Stack’s Bowers in 2022, while an MS-63 example brought $52 at a regional auction. The dramatic premium over standard 1951-D dimes reflects both rarity and strong collector demand for identifiable error coins.

Authentication proves critical with double die claims. Many sellers confuse machine doubling, a worthless strike characteristic, with genuine hub doubling. True doubled dies show sharp, complete doubling of design elements, while machine doubling creates flat, shelf-like distortions. Professional grading services like PCGS and NGC authenticate and attribute genuine double die varieties, providing confidence worth the $35 to $50 submission fee.

Over Mint Mark Errors: The Repunched Marks

1951-D dimes also appear with over mint mark errors, sometimes called repunched mint marks. These occur when mint employees manually punched mint marks into working dies using a hand-held punch. If the first punch landed incorrectly, requiring a second attempt, both impressions remain visible on struck coins.

On 1951-D over mint mark varieties, careful examination reveals remnants of the first “D” punch visible as traces, notches, or partial letters near the primary mint mark. The most dramatic examples show nearly complete secondary impressions, while subtle varieties require magnification to detect.

1951-D Over Mint Mark Values:

| Grade | Value Range |

|---|---|

| About Uncirculated (AU-53) | $30 |

| Mint State (MS-60) | $40 |

| Mint State (MS-63) | $60 |

| Mint State (MS-65) | $120 |

| Mint State (MS-67) | $200+ |

These command slightly higher premiums than double die varieties due to greater visual drama and easier identification. An MS-65 specimen sold for $118 at a 2023 Great Collections auction, while an MS-63 example brought $58. The visibility of the repunching directly correlates with value; bold, obvious varieties sell for 20% to 30% more than subtle examples at equivalent grades.

Several distinct over mint mark varieties exist for 1951-D dimes, cataloged by variety attribution services. The most valuable shows the secondary “D” clearly visible to the northwest of the primary mint mark, designated as FS-501 in the Fivaz-Stanton attribution system.

Identifying Genuine Error Coins Versus Common Damage

Many 1951 dimes show characteristics that inexperienced collectors mistake for valuable errors. Post-mint damage, environmental effects, and normal wear create doubling appearances, off-center designs, and other irregularities worth nothing beyond standard coin values.

True mint errors occur during the striking process before coins enter circulation. Key identifying features include:

Genuine hub doubling creates complete, sharp secondary images of letters and design elements at slight offsets. The doubling appears strongest on raised design features and shows consistent direction across all affected elements.

Authentic repunched mint marks display clear evidence of multiple punch impressions, with secondary images showing the same depth and character as the primary mark. Under magnification, genuine varieties reveal complete serifs and letter forms in secondary impressions.

Machine doubling, by contrast, creates flat, shelf-like extensions on one side of design elements. These worthless characteristics result from die bounce during striking and appear as distorted, mushy metal flow rather than sharp, complete secondary images.

Damage doubling occurs when circulated coins receive impacts that displace metal, creating false doubling appearances. These always show different metal flow patterns than genuine hub doubling and typically appear on random design elements rather than systematically across letter groups.

When examining potential error coins, use 5x to 10x magnification under good lighting. Genuine errors display consistent characteristics across related design elements. A true double die affects multiple letters in predictable patterns, while damage randomly affects isolated areas.

Market Performance and Investment Considerations

The 1951 Roosevelt dime market demonstrates steady appreciation, particularly for San Francisco mint coins and authenticated error varieties. Tracking auction results from Heritage, Stack’s Bowers, and Great Collections over five years reveals consistent upward trends.

Between 2018 and 2023, MS-67 1951-S dimes appreciated approximately 28%, rising from average prices of $235 to $300. MS-65 examples showed more modest 12% gains, moving from $31 to $35. This performance suggests higher grade examples outpace lower grades, typical in numismatic markets where condition rarity drives demand.

Error varieties performed even stronger. 1951-D Double Die Obverse coins in MS-65 appreciated 35% during the same period, while Over Mint Mark varieties gained 42%. These error premiums reflect growing collector sophistication and increased attribution services availability.

For collectors considering 1951 dimes as investments, several factors warrant attention:

Professional grading proves essential for coins valued above $50. The $35 to $50 cost for PCGS or NGC grading and attribution returns multiples of its cost through buyer confidence and accurate grade assignment. A raw coin claiming MS-67 might actually grade MS-65, a difference of $265 in value for 1951-S examples.

Full Bands designation adds 30% to 50% premiums for uncirculated coins. This special designation requires complete separation of all horizontal bands across the torch on the reverse, visible under magnification. Fewer than 5% of uncirculated 1951 dimes qualify for Full Bands, making this designation highly desirable.

Population reports provide critical market intelligence. PCGS reports just 23 1951-S dimes certified at MS-67, with only six achieving MS-67 Full Bands. Understanding these population numbers helps collectors gauge rarity and future appreciation potential.

Where Authentication and Grading Create Value

The difference between a $35 coin and a $300 coin often lies in professional authentication and accurate grade assignment. Third-party grading services provide standardized evaluation that establishes market confidence and enables liquid trading.

PCGS and NGC remain the industry’s most respected services. Both employ expert graders who examine coins under magnification, assess strike quality, preserve luster characteristics, and identify any errors or varieties. Coins receive numeric grades from 1 to 70, sealed in tamper-evident holders displaying the grade, variety attribution, and unique certification numbers.

For 1951 dimes, professional grading makes economic sense when:

- Raw coins appear to grade MS-65 or higher

- Potential error characteristics exist requiring expert attribution

- Coins will be sold to serious collectors demanding authenticated pieces

- Full Bands designation might apply, adding significant premiums

The submission process takes 4 to 12 weeks depending on service level, with costs ranging from $20 for bulk submissions to $100 for expedited service. The investment proves worthwhile when grading converts a $20 raw coin into a $120 certified MS-65 error variety.

Building a Complete 1951 Dime Collection

Collectors approaching 1951 Roosevelt dimes have multiple strategies depending on budget and goals. A basic three-coin set including one example from each mint costs $6 to $10 in circulated condition, providing affordable entry into silver Roosevelt dime collecting.

Intermediate collectors often pursue higher grade examples, assembling sets with coins grading MS-63 to MS-65. This approach costs $75 to $100 for the three-coin set, with the 1951-S accounting for roughly half the investment. Such collections demonstrate quality while remaining achievable for collectors with moderate budgets.

Advanced numismatists pursue variety completion, seeking both standard strikes and error varieties. A comprehensive 1951 collection including Philadelphia, Denver, and San Francisco examples plus authenticated Double Die Obverse and Over Mint Mark varieties requires $300 to $500 in MS-63 to MS-65 grades.

Registry set competitors focus on assembling the highest grade examples possible. A three-coin 1951 set in MS-67 costs approximately $410, with the 1951-S representing $300 of that total. Adding MS-67 error varieties pushes complete registry sets beyond $750.

Protecting Your Investment Through Proper Storage

Roosevelt dimes contain 90% silver, making them susceptible to environmental damage that destroys value. Proper storage preserves both numismatic premiums and underlying silver content.

Professional grading holders provide excellent long-term protection. The sealed, inert plastic cases prevent environmental exposure while displaying coins clearly. These holders require no additional protection beyond reasonable temperature and humidity control.

For raw coins, individual 2×2 cardboard holders with Mylar windows offer basic protection. These cost approximately $0.15 each and prevent handling damage while allowing examination. Never store coins in PVC-containing plastic flips, which emit chemicals that cause green corrosion called “PVC damage” that permanently destroys value.

Climate control matters significantly for silver coins. Store collections in areas maintaining 30% to 50% humidity and temperatures between 60°F and 70°F. Avoid basements, attics, and garages where humidity and temperature fluctuations accelerate toning and corrosion.

Handle coins only by edges, never touching surfaces that could receive fingerprint oils containing corrosive compounds. When examining raw coins, work over soft surfaces that prevent impact damage if coins drop.

Resources for Continued Research and Sales

Several resources provide current market values, population data, and sales results for 1951 Roosevelt dimes:

PCGS CoinFacts offers comprehensive data including population reports, auction archives, and photographic references for all 1951 varieties. The resource remains free with optional paid subscription for advanced features.

NGC Coin Explorer provides similar population data and pricing guides based on recent auction results and dealer surveys. Both services update pricing quarterly based on market transactions.

Heritage Auctions archives contain searchable records of every coin sold through their platform since 2001, showing actual realized prices rather than estimates. This database reveals authentic market values for specific grades and varieties.

USA CoinBook aggregates pricing from multiple sources, providing average retail values updated monthly. While less detailed than PCGS or NGC, it offers quick reference for common grades.

When selling 1951 dimes, options include:

- Local coin dealers provide immediate payment but typically offer 60% to 70% of retail value

- Online marketplaces like eBay reach broad audiences but involve 13% to 15% fees and fraud risks

- Auction houses like Heritage or Stack’s Bowers maximize returns for valuable pieces but charge 10% to 20% seller fees

- Direct collector sales through forums eliminate middleman costs but require numismatic knowledge and networking

Finding These Coins in Circulation Today

While finding 1951 dimes in pocket change seems unlikely given their 90% silver content, thousands remain in old collections, estate sales, and inherited accumulations. Many homeowners possess jars of pre-1965 silver coins saved by parents or grandparents that include 1951 specimens.

Estate sales and garage sales occasionally yield old coin collections where sellers lack knowledge about specific values. Purchasing entire collections for silver weight sometimes produces valuable varieties trading well above melt value. A $50 investment in a mixed silver coin lot might include a 1951-S dime in MS-65 condition worth $35 alone.

Bank rolls represent another discovery source, though chances decline yearly as remaining silver coins exit circulation. Some collectors maintain relationships with local banks, examining customer deposits for silver coins and purchasing any found at face value.

When searching for 1951 dimes, examine mint marks carefully using magnification. The difference between a $2 Philadelphia coin and a $4 San Francisco coin hinges entirely on that small “S” mint mark, while error varieties require even closer inspection to identify valuable doubled dies or repunched mint marks.

Making Your Next Move With 1951 Dimes

Whether you’re examining old family collections or considering purchases for investment or hobby purposes, 1951 Roosevelt dimes offer genuine value opportunities. Start by carefully examining any 1951 dimes in your possession under magnification, checking for San Francisco mint marks and potential error characteristics. Raw coins showing sharp details without wear warrant professional grading consideration, particularly for 1951-S examples or suspected error varieties. For collectors building sets, focus acquisition efforts on authenticated MS-65 or higher examples, where future appreciation potential exceeds lower grade alternatives. The combination of silver content, collecting demand, and genuine rarity in top grades creates sustainable value across this accessible yet rewarding series.

You may be interested:

- 1859 Indian Head Penny Coin Value Complete Errors List And No Mint Mark Worth Guide For Collectors

- 1911 V Nickel Coin Value Guide Complete Errors List And No Mint Mark Worth Today

- 1902 Dime Coin Value Complete Errors List With O S And No Mint Mark Worth Guide

- 1788 Quarter Coin Value Complete Guide Errors List And D S P Mint Mark Worth Revealed

- 1776 To 1976 Bicentennial Half Dollar Coin Value Complete Errors List And What Your D S And No Mint Mark Coins Are Actually Worth

- 1990 Penny Coin Value Errors List How D S And No Mint Mark Pennies Are Worth Thousands Of Dollars

What is a 1951 S dime worth?

A 1951-S dime is worth about $4.10 to $4.60 in circulated condition, but the value can increase to over $500 for uncirculated coins with a high grade and desirable features like Full Bands (FB). The coin’s value depends on its condition, with rarer, high-grade specimens commanding significantly higher prices.

Which dimes with no mint mark are worth money?

Dimes with no mint mark can be valuable if they are 1968-S No-S Proof, 1970-S No-S Proof, or 1982 No-S business strike Roosevelt Dimes, as these are rare error coins. However, most dimes from 1965–1967 lack a mint mark because it was deliberately removed from coins at the time, making them very common and not valuable beyond their face value.

What errors to look for on dimes?

When looking for valuable dime errors, check for coins with a double die obverse, where features like the date or motto are doubled, as well as errors in the striking process, such as an off-center strike or a broadstrike where the collar is missing. Other errors include missing or clipped planchets, missing clad layers, or striking through debris like cloth (a strikethrough error ).