A 1974 nickel without a mint mark (Philadelphia-minted) is typically worth $1-$2 in circulated condition. However, pristine uncirculated coins graded MS-66 or higher can reach approximately $1,000, with rare varieties potentially worth more. The “D” mint mark indicates Denver production, while “S” denotes San Francisco proof coins—a high-grade 1974-S proof deep cameo can be valued up to $2,500. Coin value depends heavily on condition, mint mark presence, and potential errors like broadstriking. Collectors should carefully examine their coins for these features to determine accurate worth.

That handful of nickels from 1974 sitting in your change jar might be worth more than five cents—but probably not. While most 1974 Jefferson nickels are common circulation coins, specific varieties and high-grade specimens can command surprising prices. Understanding which mint produced your coin and what condition it’s in makes all the difference between spending it at the store or selling it for hundreds of dollars.

What Makes a 1974 Nickel Valuable

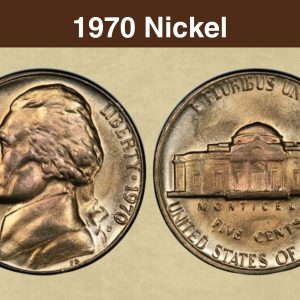

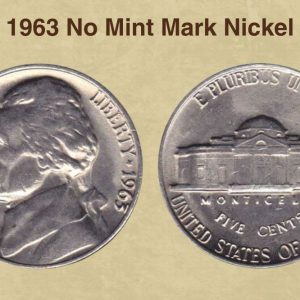

The 1974 Jefferson nickel was produced at three facilities: Philadelphia (no mint mark), Denver (D), and San Francisco (S for proofs only). The United States Mint struck over 600 million nickels that year, making them abundant in circulation today. The composition remained standard—75% copper and 25% nickel—with no precious metal content that would increase melt value.

Most 1974 nickels trade at face value or slightly above. A circulated example typically sells for $0.10 to $0.50 in average condition. The market changes dramatically when you examine uncirculated specimens graded by professional services like PCGS or NGC. A coin graded Mint State 65 (MS-65) might fetch $15 to $30, while MS-66 examples can reach $75 to $150. The real excitement begins at MS-67 and higher.

Philadelphia struck approximately 601,752,000 nickels without mint marks in 1974. Denver added another 277,373,000 coins marked with a small “D” on the reverse, just below the date on the obverse. San Francisco produced 2,612,568 proof coins exclusively for collectors, distinguished by their mirror-like surfaces and sharp details.

Philadelphia No Mint Mark Nickel Values

The 1974 Philadelphia nickel represents the largest production run and the most common variety you’ll encounter. Without a mint mark beneath the date, these coins flooded circulation and remain easy to find in pocket change today.

Grade-Based Pricing:

| Grade | Value Range |

|---|---|

| Good to Fine (G-4 to F-12) | $0.05 to $0.10 |

| Very Fine (VF-20 to VF-35) | $0.10 to $0.25 |

| Extremely Fine (EF-40 to AU-58) | $0.30 to $0.75 |

| MS-60 to MS-63 | $1.50 to $8.00 |

| MS-64 | $10 to $20 |

| MS-65 | $25 to $50 |

| MS-66 | $100 to $200 |

| MS-67 | $800 to $1,500 |

Heritage Auctions sold an MS-67 1974 no mint mark nickel for $1,410 in January 2022, demonstrating the premium collectors pay for pristine examples. The population reports from PCGS show only 47 coins graded MS-67, with just two specimens certified at MS-67+—none graded higher. This scarcity at the top end drives values upward.

For circulated coins, condition matters less since wear reduces detail uniformly across millions of examples. The jump in value occurs when examining uncirculated pieces. An MS-63 coin shows minor bag marks and acceptable luster, while MS-65 displays strong luster with only minor contact marks visible under magnification. MS-66 and higher specimens exhibit exceptional eye appeal with virtually no distracting marks.

Denver D Mint Mark Nickel Worth

The Denver Mint produced roughly 277 million nickels in 1974, identifiable by the small “D” mint mark located on the obverse (front) below the date. While less common than Philadelphia strikes, Denver nickels still appear frequently in circulation.

Value progression follows a similar pattern to Philadelphia coins, though subtle market differences exist:

| Grade | Value Range |

|---|---|

| G-4 to VF-35 | $0.05 to $0.20 |

| EF-40 to AU-58 | $0.35 to $0.80 |

| MS-60 to MS-63 | $2.00 to $10.00 |

| MS-64 | $12 to $25 |

| MS-65 | $30 to $60 |

| MS-66 | $125 to $250 |

| MS-67 | $900 to $2,000 |

The Denver variety shows slightly stronger demand among variety collectors who pursue complete date-and-mint-mark sets. A PCGS MS-67 example sold for $1,880 through GreatCollections in March 2023, reflecting collector interest in top-tier specimens.

Denver nickels generally exhibit sharper strikes than Philadelphia coins from this era, though individual pieces vary. Mint employees adjusted die pressure and spacing differently at each facility, creating subtle distinctions in detail sharpness. A well-struck Denver nickel often shows fuller details on Jefferson’s hair and Monticello’s columns, features that grading services consider when assigning numerical grades.

San Francisco S Proof Nickel Values

The San Francisco Mint exclusively produced proof coins in 1974, striking 2,612,568 special specimens for collector sets. These proofs feature mirror-like fields and frosted devices, created through multiple strikes on specially prepared planchets. Every proof carries an “S” mint mark below the date.

Proof Pricing Structure:

| Grade | Value Range |

|---|---|

| PR-65 | $3 to $6 |

| PR-66 | $6 to $10 |

| PR-67 | $10 to $18 |

| PR-68 | $20 to $40 |

| PR-69 | $60 to $150 |

| PR-70 Deep Cameo | $2,000 to $3,500 |

The term “Deep Cameo” or “DCAM” describes proofs with maximum contrast between frosted devices and mirror fields. Modern grading services designate these superior specimens separately, and collectors pay substantial premiums. A PCGS PR-70 Deep Cameo 1974-S nickel sold for $3,290 at Heritage Auctions in April 2023, establishing a benchmark for perfect examples.

Most 1974-S proofs grade between PR-65 and PR-68, reflecting careful handling by collectors who purchased original sets. The United States Mint sold these sets directly to collectors for $7.00 in 1974, including the cent, nickel, dime, quarter, and half dollar. Sets remained in original packaging often retain higher grades than individually stored coins.

Standard cameo proofs (designated “CAM”) fall between regular proofs and deep cameos in value, typically commanding 30% to 50% premiums over non-cameo examples at the same grade level. The visual impact of contrast drives collector preference and market pricing.

Valuable 1974 Nickel Errors and Varieties

Error coins attract dedicated collectors who pay premiums for manufacturing mistakes. The 1974 nickel offers several documented errors worth examining your coins for.

Doubled Die Obverse: This error shows doubling on design elements, most visible in “IN GOD WE TRUST” and the date. A strong doubled die 1974 nickel in MS-64 condition sold for $425 in 2021. Minor doubling adds $10 to $30 in circulated grades, while dramatic examples command hundreds.

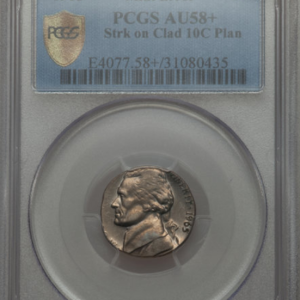

Broadstrike Error: Occurs when the collar die fails to contain the planchet during striking, creating an irregularly shaped coin larger than normal diameter. A 1974-D broadstrike in MS-62 brought $180 at auction in 2022. The dramatic appearance makes these errors popular with collectors.

Off-Center Strikes: The die strikes the planchet off-center, leaving blank areas. Value depends on percentage off-center and whether the date remains visible. A 15% off-center 1974 nickel with full date sells for $40 to $75, while 40% to 50% off-center examples reach $150 to $300. Heritage Auctions sold a 55% off-center 1974-D for $336 in January 2023.

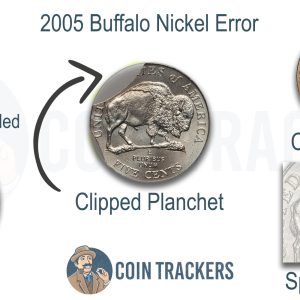

Clipped Planchet: A curved or straight clip missing from the coin’s edge, caused by improper planchet punching. Straight clips typically add $15 to $40 in value, while curved clips from the planchet edge command $20 to $50 depending on size.

Die Cracks and Cuds: Raised lines from cracked dies add modest premiums of $5 to $25 for minor cracks. Major “cuds”—raised blobs where die pieces broke away—can bring $75 to $200 depending on size and location.

Wrong Planchet Errors: Extremely rare instances of 1974 nickels struck on dime planchets or other denominations command four-figure prices. No verified examples have appeared at major auctions recently, though rumors persist in collector circles.

The Professional Coin Grading Service and Numismatic Guaranty Company authenticate errors for fees ranging from $20 to $150 depending on service level. Certification proves authenticity and typically increases resale value by protecting buyers from counterfeits.

How to Identify Your 1974 Nickel’s Mint Mark

Locating the mint mark requires examining the coin’s obverse with good lighting. The mint mark appears on the right side of the coin, below the date and to the right of Jefferson’s portrait. Use a magnifying glass with at least 5x magnification for clear viewing.

Philadelphia coins display no mint mark—the area remains blank. Denver nickels show a small “D” approximately 1.5 millimeters tall. San Francisco proofs feature an “S” of similar size. Mint marks were hand-punched into working dies during this era, causing slight variation in position and depth between individual dies.

Some collectors mistake damage or debris for mint marks. Authentic mint marks appear as integral parts of the die design with consistent depth and smooth edges. Scratches, post-mint damage, or foreign material look irregular under magnification.

Cleaning the area gently with a soft cloth removes dirt that might obscure the mint mark. Never use abrasive cleaners or metal polish, which create hairline scratches that permanently reduce value. Professional numismatists recommend holding coins by the edges and viewing them at an angle under bright, indirect light.

Determining Grade and Condition

Grading represents the single most important factor in 1974 nickel values. The Sheldon Scale runs from 1 (barely identifiable) to 70 (perfect), with specific grade ranges indicating wear levels.

Circulated Grades:

- Good (G-4): Heavy wear with major design elements visible but flat

- Fine (F-12): Moderate wear with some detail remaining in hair and building

- Very Fine (VF-20 to VF-35): Light to moderate wear with most details clear

- Extremely Fine (EF-40 to EF-45): Slight wear on highest points only

- About Uncirculated (AU-50 to AU-58): Traces of wear on highest points with most mint luster remaining

Uncirculated Grades:

- MS-60 to MS-62: No wear but numerous bag marks and poor luster

- MS-63: Moderate contact marks with acceptable luster

- MS-64: Few contact marks with good luster and eye appeal

- MS-65: Minor marks visible only under magnification with strong luster

- MS-66: Virtually mark-free with excellent luster and strike

- MS-67 and higher: Exceptional specimens approaching perfection

The grading process examines luster, strike quality, contact marks, and eye appeal. Jefferson’s cheekbone and hair above his ear show wear first on circulated coins. On the reverse, Monticello’s steps and columns lose definition with handling. Full Steps designation (FS) applies when all five or six steps remain completely separated and sharp—a feature that adds 50% to 100% premium at higher grades.

Professional grading through PCGS or NGC costs $20 to $40 for modern coins, with results typically received within 30 days. Services encapsulate coins in tamper-evident holders with grade labels, providing authentication and protection. The investment makes sense for coins potentially grading MS-66 or higher, where the certification premium exceeds service costs.

Where to Buy and Sell 1974 Nickels

Multiple marketplaces serve coin collectors, each with advantages for buying or selling 1974 nickels.

Online Auction Platforms: Heritage Auctions and GreatCollections specialize in numismatic material, attracting serious collectors willing to pay market rates. Seller fees range from 10% to 20%, but competitive bidding often produces strong prices. eBay offers broader reach with lower fees (12.35% to 12.55% for coins) but requires careful research to avoid overpricing or fraud.

Coin Dealers: Local shops provide immediate payment but typically offer 50% to 70% of retail value when purchasing. Selling to dealers works best for common coins or quick transactions. Established dealers belong to the Professional Numismatists Guild and adhere to ethical standards.

Coin Shows: Regional and national shows create opportunities to compare multiple dealer offers and network with collectors. The American Numismatic Association sponsors major shows featuring hundreds of dealers. Direct transactions avoid online fees and shipping costs.

Online Retailers: APMEX, JM Bullion, and other major retailers stock certified coins with detailed photos and return policies. Prices run 10% to 25% higher than auction results but eliminate bidding uncertainty. These sources work well for collectors building sets who need specific dates and grades.

Certified Coin Exchanges: The Certified Coin Exchange (CCE) and similar platforms allow buying and selling graded coins at bid/ask spreads, functioning like stock markets. Transaction fees remain low (typically 3% to 5%), though liquidity varies by coin rarity.

Before selling valuable 1974 nickels, obtain multiple offers. A coin worth $1,000 at auction might generate offers from $500 to $750 from different dealers depending on their inventory needs and customer base. Professional grading establishes objective value and prevents disputes over condition.

Building a Complete 1974 Nickel Collection

Collectors pursue different strategies when assembling 1974 nickel holdings. A basic three-coin set includes one example from each mint: Philadelphia (no mint mark), Denver (D), and San Francisco proof (S). This modest collection costs $10 to $30 in circulated grades or $100 to $200 in MS-65 condition.

Advanced collectors target specific varieties and errors. A comprehensive 1974 collection might include:

- Regular strikes from Philadelphia and Denver in MS-65 or higher

- Complete proof set from PR-65 to PR-69 Deep Cameo

- Major error varieties: doubled die, broadstrike, significant off-center

- Full Steps examples from each mint

- Toned specimens with attractive color

The Full Steps designation particularly challenges collectors. Fewer than 5% of 1974 nickels show complete step separation on Monticello’s stairs due to die wear and striking pressure variations. A 1974-D Full Steps MS-66 commands $400 to $600 compared to $125 to $250 for regular MS-66 examples.

Storage matters for long-term value preservation. Individual coins belong in non-PVC flips or airtight capsules. Complete sets fit in albums from Whitman or Dansco, though direct contact with cardboard over decades can cause toning that some collectors prize while others avoid. Certified coins remain in their original holders unless conserved by professionals.

Climate control prevents environmental damage. Humidity above 60% encourages corrosion and toning, while extremely dry conditions can cause holder shrinkage. Room temperature storage away from direct sunlight preserves both coins and packaging indefinitely.

Smart Investment Strategies for 1974 Nickels

Investment potential varies dramatically across 1974 nickel varieties. Common circulated examples offer no financial upside—millions exist with identical characteristics and nominal value. The investment case strengthens when examining population-rare specimens in top grades.

Population Dynamics: Only 49 1974 Philadelphia nickels grade MS-67 or higher at PCGS, representing 0.00008% of the original 601 million mintage. Assuming similar survival rates at NGC and other services, perhaps 150 coins worldwide meet this standard. Compare this to continuing collector demand and the scarcity becomes apparent.

Historical Price Trends: An MS-67 1974 no mint mark nickel sold for $750 in 2015, $1,175 in 2019, and $1,410 in 2022—an 88% increase over seven years despite overall coin market fluctuations. MS-67 Denver coins showed similar appreciation from $850 to $1,880 during the same period.

Proof Performance: High-grade proofs demonstrate stronger returns. PR-69 Deep Cameo examples traded at $75 to $100 in 2010, reaching $150 to $200 by 2020. The single PR-70 DCAM specimen selling for $3,290 in 2023 established a new benchmark that supports values throughout the grade range.

Risk Factors: Market corrections affect all collectibles. The 2008-2009 financial crisis temporarily suppressed coin prices by 20% to 40% before recovery. Population increases from new submissions can dilute rarity premiums—if PCGS suddenly grades ten more MS-67 1974-P nickels, values for existing holders might decline 10% to 15%.

Diversification: Serious investors spread purchases across multiple dates, denominations, and grade levels rather than concentrating on a single coin. A $5,000 budget might include five MS-67 nickels from different years rather than one MS-68 specimen, balancing potential appreciation against liquidity.

Third-party grading fees, auction commissions, and market spreads consume 15% to 30% of initial investment, requiring equivalent appreciation before breaking even. Patient collectors who buy selectively and hold for years typically achieve better outcomes than short-term traders.

Maximizing Value When Selling Your 1974 Nickels

Timing and presentation significantly impact sale proceeds. Coins sold during strong markets or through optimal channels command premiums versus distress sales or poor venue selection.

Market Timing: Numismatic markets fluctuate with economic conditions and collector demographics. The period from January through March typically shows strength as collectors spend holiday money and tax refunds. Summer months (June through August) often soften as vacation spending diverts discretionary income. Major auction houses schedule important sales around industry conventions, creating peak demand periods.

Photography: High-quality images increase online sale prices by 15% to 25% compared to poor photos of identical coins. Use a camera capable of macro photography with at least 12 megapixel resolution. Photograph both sides under diffused lighting at slight angles to show luster. Include close-ups of mint marks and noteworthy features.

Description Accuracy: Detailed, honest descriptions build buyer confidence and reduce return rates. Specify grade (using PCGS or NGC terminology), mention any defects visible, and note positive attributes like strike quality or luster. Avoid subjective claims like “rare” or “investment grade” unless supported by population data.

Authentication: Raw (uncertified) coins grading MS-66 or higher should receive professional certification before sale unless selling to dealers who will certify themselves. The $30 grading fee converts to $100+ in additional sale proceeds when buyers see third-party validation. Errors and varieties particularly benefit from expert authentication.

Multiple Listings: Creating individual listings for better coins while lotting common pieces maximizes returns. Selling ten circulated 1974 nickels individually earns $5 to $10 total minus ten listing fees. Offering the same ten as a single lot brings $8 to $12 with one listing fee, improving net proceeds.

Reserve Prices: Setting appropriate reserves prevents selling valuable coins below market during slow auctions. Research recent sales of comparable graded examples and set reserves at 70% to 80% of typical hammer prices. Unrealistically high reserves discourage bidding—balance protection against market access.

Professional networking helps when selling high-value coins. Dealers specializing in Jefferson nickels maintain customer want lists and pay premiums for desired dates and grades. Joining the American Numismatic Association (annual membership $46) provides access to dealer directories and educational resources that improve selling outcomes.

Start Checking Your Change Today

The majority of 1974 nickels remain common circulation coins worth five cents, but exceptional specimens reward careful searching. Focus your attention on uncirculated examples saved from original mint sets, proofs purchased in 1974, and coins showing obvious striking errors. A $5 roll of nickels from your bank might contain a future $1,000 coin if you develop the eye to spot quality and rarity.

Build relationships with local coin dealers who can evaluate potential finds and provide market insights. Join online communities through forums like CoinTalk where experienced collectors share knowledge freely. Start with inexpensive examples to learn grading standards before investing in premium pieces. Your 1974 nickel collection represents both an enjoyable hobby and a potential financial asset—outcomes improve dramatically when you combine knowledge with patience.

You may be interested:

- 1859 Indian Head Penny Coin Value Complete Errors List And No Mint Mark Worth Guide For Collectors

- 1911 V Nickel Coin Value Guide Complete Errors List And No Mint Mark Worth Today

- 1902 Dime Coin Value Complete Errors List With O S And No Mint Mark Worth Guide

- 1788 Quarter Coin Value Complete Guide Errors List And D S P Mint Mark Worth Revealed

- 1776 To 1976 Bicentennial Half Dollar Coin Value Complete Errors List And What Your D S And No Mint Mark Coins Are Actually Worth

- 1990 Penny Coin Value Errors List How D S And No Mint Mark Pennies Are Worth Thousands Of Dollars

Is a 1974 nickel with no mint mark worth anything?

A 1974 nickel without a mint mark is a standard Philadelphia-minted coin and is worth its face value, or around $1 to $2 in circulated condition. For it to be worth more, it must be in pristine, uncirculated condition (MS-66 or higher) and can be valued at approximately $1,000, with prices potentially reaching much higher for specific rare varieties or proof versions.

What are error nickels to look for?

Key nickel errors to look for include doubled dies, where design elements are doubled due to die strikes, off-center strikes, where the coin is struck outside its intended position, and mint mark errors, such as doubled or missing mint marks. Other valuable errors are speared bison on 2005 nickels, the 1943 double die Jefferson nickel, and 1937-D Buffalo nickel three legs.

Is a 1974 No mint mark worth anything?

A 1974 no mint mark aluminum penny is estimated to be worth $160,000 and can sell for up to $2 million in uncirculated condition. Other high-value examples include a 1974 Lincoln cent from the Philadelphia Mint that set an auction record at 2,938 dollars.

What nickel is worth $10,000 no mint mark?

In 1942 at Philadelphia. They made no mintmark nickels but they were not 35% silver they had no silver in them they were the regular copper nickel composition.